In the aftermath of the Rwandan Genocide, The Second Congolese War destroyed businesses, local infrastructure, and family units throughout Moba District and Katanga Province. Moba-Kirungu and Moba-Port are two adjacent towns situated on Lake Tanganyika in the Moba District of Katanga Province. Collectively, the two towns form a lively port hub known as Moba.

The population is estimated at 150,000 people, and thousands of returning refugees are now settling or resettling in the area. Moba, however, still remains alarmingly under-developed for its size and potential.

- There are only two small markets in Moba where basic necessities can be bought.

- The majority of people in the area are fishermen and farmers by necessity, not by choice.

- Families tend to be quite large, often with eight to ten children.

As a result of the tremendous loss experienced by those who endured the war or lived as refugees dependent on aid, the average person has little to no resources to provide for themselves or their families. This lack of relative wealth – combined with the absence of access to start-up capital – has created a situation where the ability to develop even a small business has been nearly impossible.

It is because of Moba’s development needs, rapid population growth (due to returning refugees), and lack of capital that the need for micro-credit loans in the area is ESSENTIAL. Hence, the Moba Community Development Center (MCDC) was created.

When I returned from the refugee camp I was struggling. With the profits I made through my business loan, I was able to buy a goat that had two babies. Now we’re sending three of our children to school. – Former Refugee, loan recipient

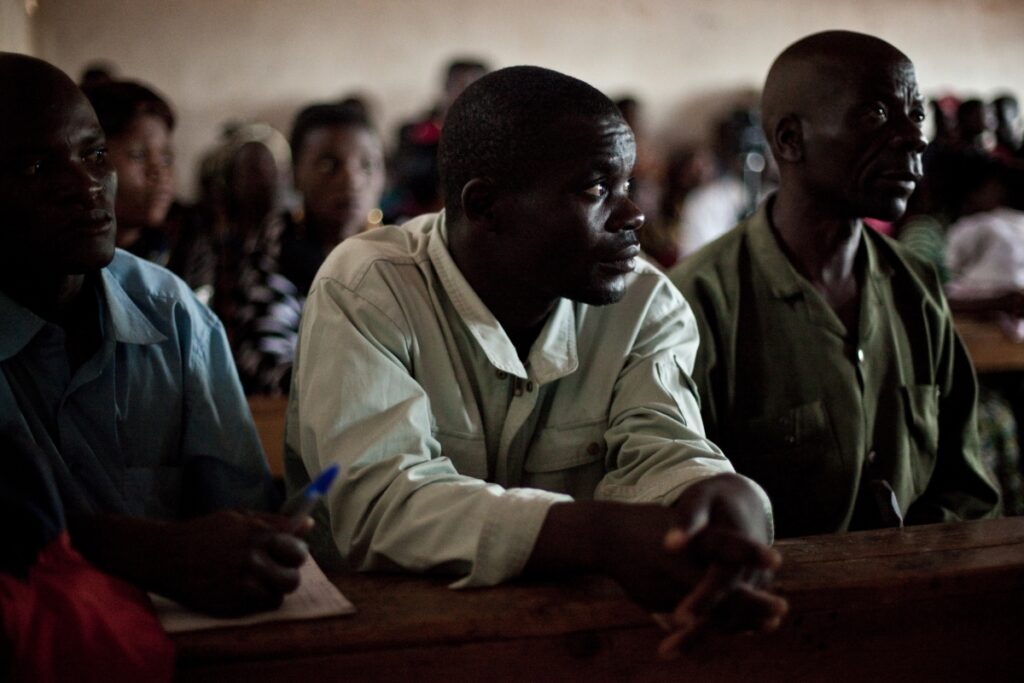

How does the MCDC work? The MCDC derives its structure from the successful ideas of Nobel Peace Prize recipient Muhammad Yunus, founder of the Grameen Bank. The MCDC process is as follows:

- Twice a year, TRP executives and local staff oversee an application period for Moba residents who wish to apply for a loan.

- After attending the required business seminars, individual loan recipients organize themselves into their OWN groups of five – three of whom must be women. This self-organization is important. The formation of these recipient groups replace the need for “traditional collateral” by acting as what Muhammad Yunus has termed as “social collateral.” Thus, it instills the critical element of trust within these groups

- Each group member is interviewed by TRP staff to determine the needs of the individual and/or how the business could contribute to the community at large.

- After the FIRST recipient in that group receives their loan, they have one month to make their first installment.

- Once the FIRST loan recipient pays back the first installment with their initial profits (and conditional on this repayment), the SECOND person in the group will receive their loan, and so on.

MCDC loans range from six to nine months. Loan recipients pay 1% interest per month during this period in order to ensure sustainability. If everyone in the group is able to repay their loan and there is evidence of improvement in their lives, they are eligible to apply for another loan during a following round.

Since December 2010, the MCDC has approved over 500 individual loans. Their businesses include pharmacies, tailoring, soap making, carpentry, agriculture, husbandry, baking, and other small business activities.

The site visits and observations made in Moba during TRP’s most recent return trip saw significant improvements in many of the loan recipients’ standard of living, access to health care, and in the education of their children.